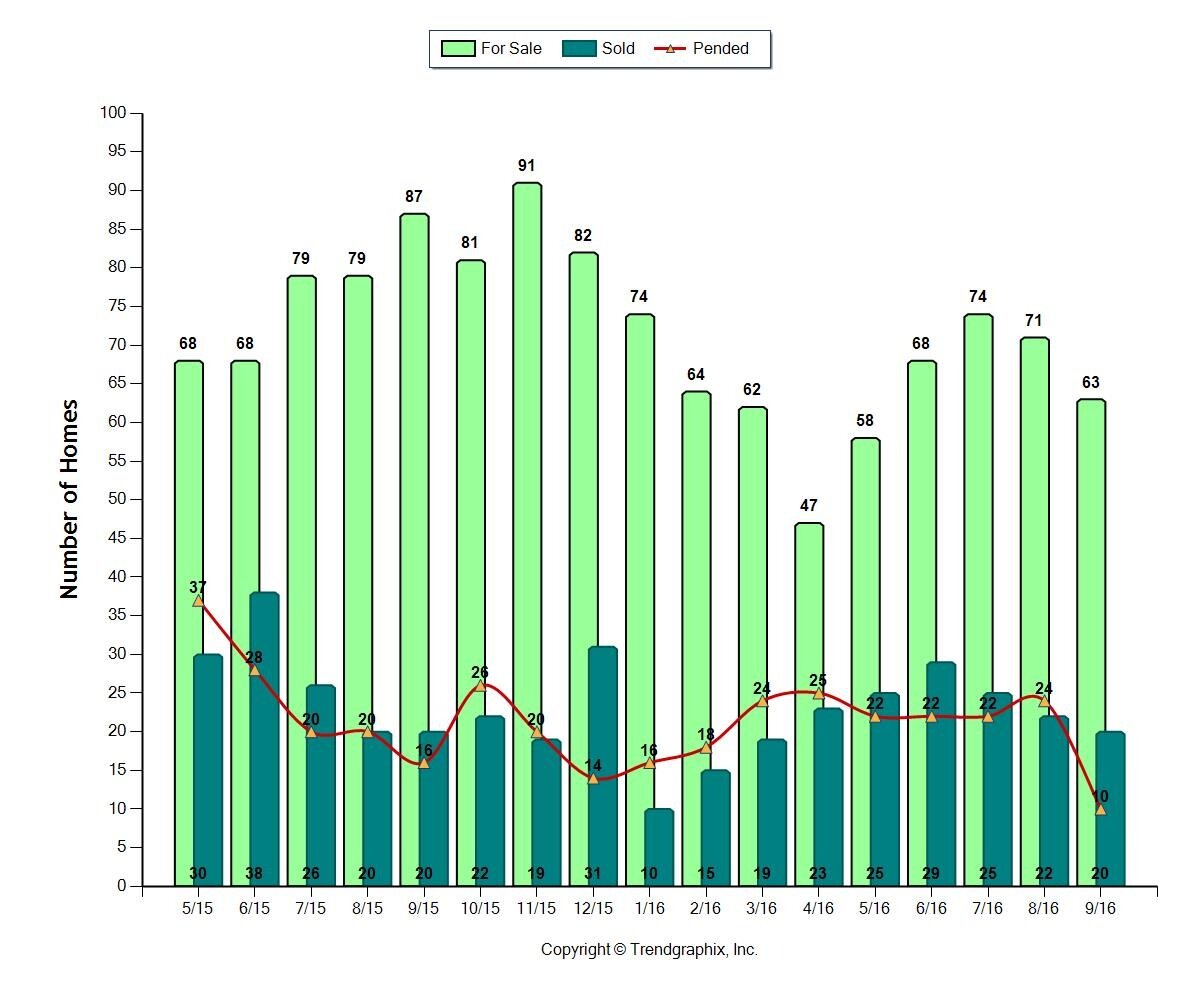

Summary of market activity, all homes in 15217 & 15207 up to $300,000

Years ago when we first discovered Greenfield many referred to it as "Pittsburgh's best kept secret," but within the last couple years the word is out and the market has heated up. We predicted the market might dip a little bit while the bridge was down, but prices have continued to trend up as the market's stabilized. The third quarter of 2016 proved to be another strong season for Greenfield with over 65 homes sold between July and September.

Inventory in Greenfield remained steady throughout the third quarter as well, shifting from a Seller's market in early Summer to a neutral market at 3.1 months of inventory, based on:

Seller's Market: Under 3 months of inventory

Neutral Market: 3 - 6 months inventory

Buyer's Market: 6mo+ inventory

This increase in inventory is a normal trend from August through December, as many buyers try to close on their house before the start of school. In fact, Fall is easily the best time of year to buy your first home or upgrade into your forever home.

Here are four great reasons to buy a home in Greenfield this Fall:

1. Less competition: Over the Summer, three and four bedroom homes in Greenfield would disappear faster than the old Greenfield bridge. Several homes on McCaslin alone went under contract less than a week after listing, leaving buyers little time to make a decision about which house is best for them. With fewer buyers looking in the Fall, you can feel more confident about your offer without pressure from too many other buyers.

2. Sellers are motivated: Most sellers listing in the Fall are moving for a reason, especially if they listed their house towards the end of Summer and have now been sitting in a quieter market. Sometimes sellers have even moved to their new location, and don't want to worry about Winter heating bills so they may be willing to negotiate a lower price.

3. Perfect time to upgrade: Have you been thinking about moving up to a larger home, and want to find the ideal time to sell your current home and buy your next one? The average Sold price in Greenfield is up 6.5% from $145,000 in 2015 to $155,000 in 2016. This means you can get max value for your current home, AND your dream home at a great price. You can also take advantage of Howard Hanna's Buy Before You Sell program to use up to 70% of your home's appraised value to buy your new home while your current home is still on the market.

4. Tax advantages: Buying a home in the Fall may mean you can write off a big chunk of your closing costs and mortgage interest on your 2016 tax return, which could provide significant savings in the Spring. Not to mention conventional mortgage interest rates are still below 4%, which can save you thousands each year on your loan!

If you have questions or are ready to start looking for a home in Greenfield this Fall, give us a call or send us a note and we would love to talk to you!

Cheers,

Julie & Ted